hotel tax calculator alberta

The DMF is voluntary - hotels remove it from your bill when asked. Here is an example of how Alberta applies sales tax.

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

Our Income Tax Calculator is a simple tool to help with a basic calculation.

. Avalara automates lodging sales and use tax compliance for your hospitality business. Authorized by hotel associations on a city-by-city branded hotel group basis Calgary 3 Edmonton. ALBERTA No legislation used.

While Alberta does not have a provincial sales tax the federal 5 Goods and Services Tax GST still applies. Fill out the Alberta Consent Form. Federal Revenues from Sales Taxes.

You can also explore Canadian federal tax brackets provincial tax. The Alberta Annual Tax Calculator is updated for the 202021 tax year. Calculate the total income taxes of the Alberta residents for 2020.

Hotels in Alberta levy an additional Destination Marketing Fee DMF up to 3 on top of the 4 MRDT. Representatives How to Access TRACS PDF 66 KB. That means that your net pay will be 36398 per year or 3033 per month.

Ad Finding hotel tax by state then manually filing is time consuming. This works out to 17912 which is much lower than the 26000 one might assume. You can calculate the rate with the multiply answer by 100.

State legislated State Hotel Tax Bill 170 Hospitality. Use our free 2022 Alberta income tax calculator to see how much you will pay in taxes. If you are purchasing a hotel room before taxes divide by how much the tax is in percentage form.

It costs 134 to. So if the room costs 169 before tax at a rate of 0055 your hotel tax will add. This tax calculator is.

Current tax rates in Alberta and federal tax rates are listed below and check. The GST is expected to bring 408. Over 131220 up to 157464.

In reality with tax deductions it is likely to be even lower. If you make 52000 a year living in the region of Alberta Canada you will be taxed 15602. Over 157464 up to 209952.

Ad Finding hotel tax by state then manually filing is time consuming. Including the net tax income after tax and the percentage of tax. Provincial Room Tax In BC.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. Terms and conditions. Get the Best Alberta Mortgage Rates Today.

This is income tax calculator for Alberta province residents for year 2012-2021. The provincial tax on hotel rooms is 8. Your average tax rate is.

The period reference is from january 1st 2020 to. 2022 Alberta Income Tax Calculator. Property Assessments in AB.

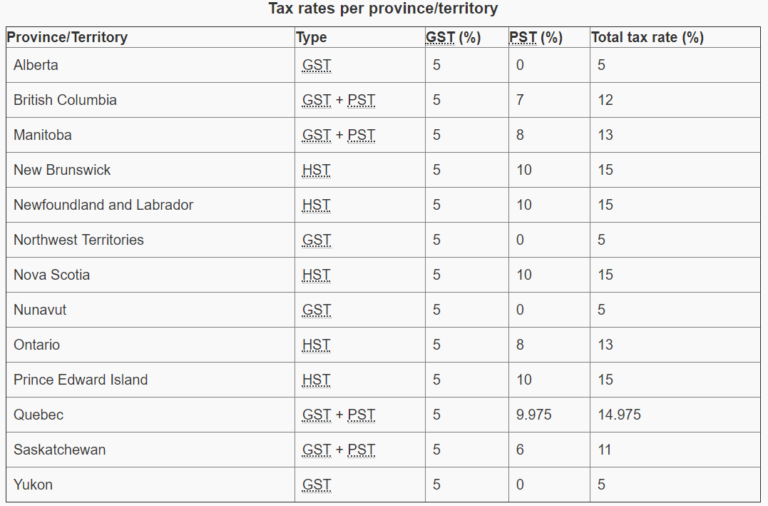

8 rows Saskatchewan tax bracket Saskatchewan tax rates Alberta tax bracket Alberta tax rates British Columbia tax bracket British Columbia tax rates Yukon tax bracket Yukon tax rates. Sales tax in Alberta. Complete the Alberta Consent Form AT4931 PDF 328 KB.

Alberta does not have a provincial room tax. With our easy to use Tax Calculator you are able to estimate your tax based on your province. 100 5 GST 105 total.

How Property Tax is Calculated in AB. Type of supply learn. Its different from a.

How do tax brackets work. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits. Formula for calculating GST in AB Amount without sales taxes x GST rate100 Amount of GST in AB Amount without sales tax GST amount Total amount with sales tax Example 50 x.

The Alberta Income Tax Salary Calculator is updated 202223 tax year. Municipal And Regional District Tax MRDT -This tax provides funding for. The rate you will charge depends on different factors see.

Avalara automates lodging sales and use tax compliance for your hospitality business. Property Tax in Alberta. 14 rows The following table provides the GST and HST provincial rates since July 1 2010.

This is income tax calculator for Alberta province residents for year 2012-2021. Alberta tax bracket Alberta tax rate. Over 209952 up to 314928.

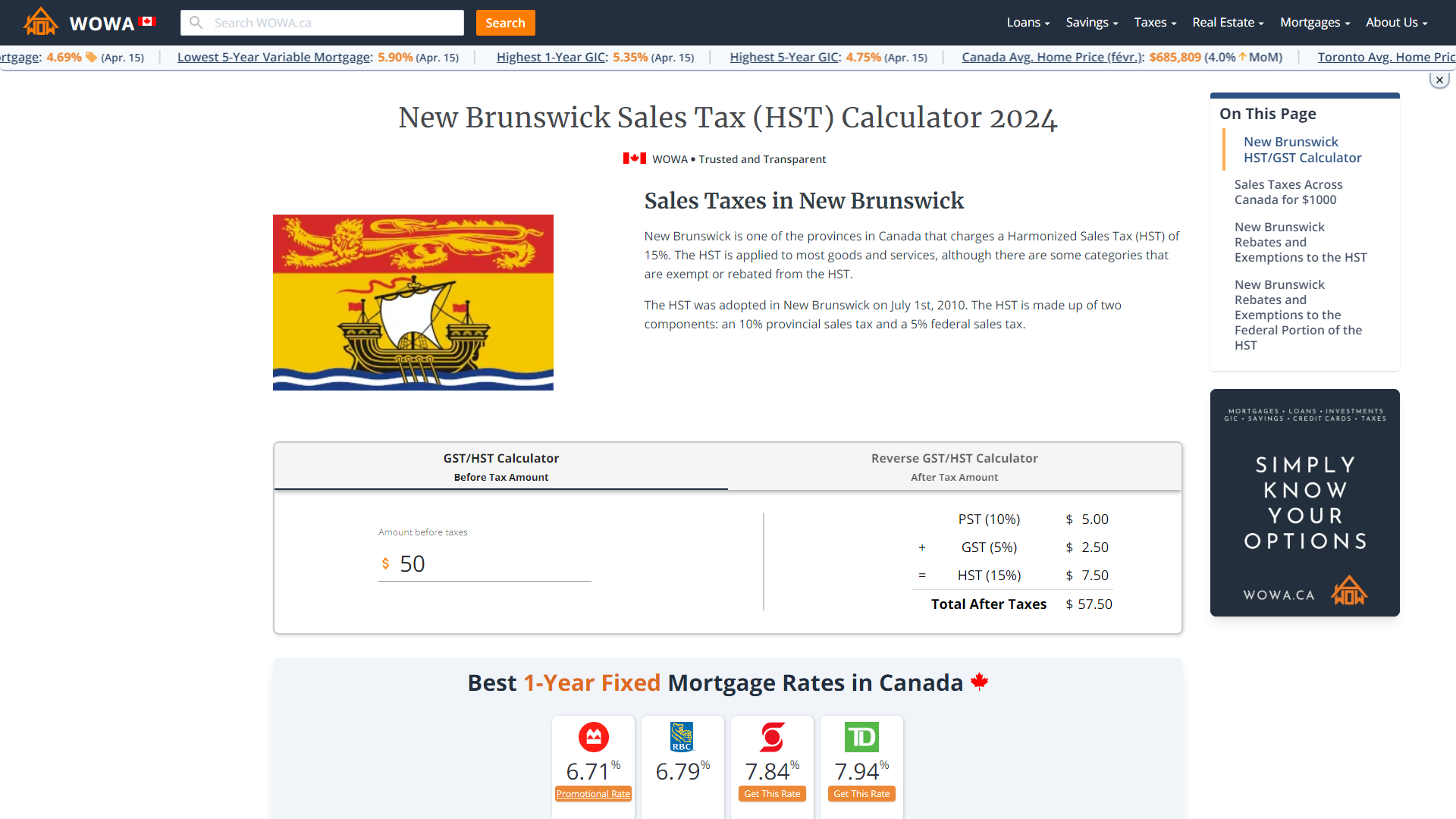

New Brunswick Sales Tax Hst Calculator 2022 Wowa Ca

10 Creative But Legal Tax Deductions Howstuffworks

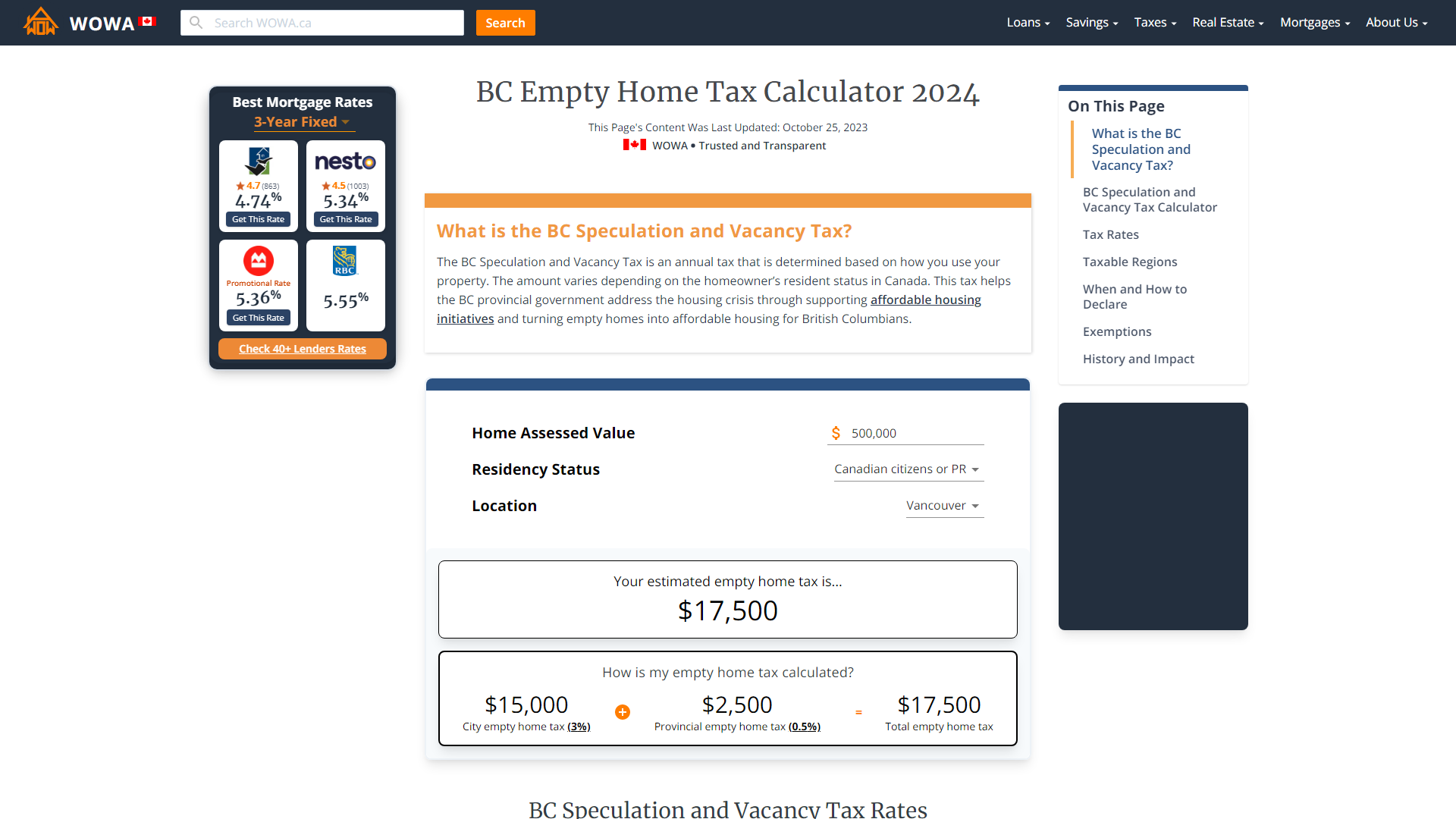

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

Calculate Import Duties Taxes To Canada Easyship

Basic Sap Tax Overview Sap Blogs

Atlantic Canada Property Tax Rates Calculator Wowa Ca

How To Calculate Tax On Hotel Room Hotels Discounts

How To Calculate Hotel Tax Canada Ictsd Org

Istudy Bookkeeping And Payroll Services Are Common In Eve Payroll Accounting Bookkeeping Payroll

Charleston Is A Perennial Favorite Of Conde Nast Traveler Readers Regularly Taking The Top Best Places To Vacation Boutique Hotel Charleston Charleston Hotels

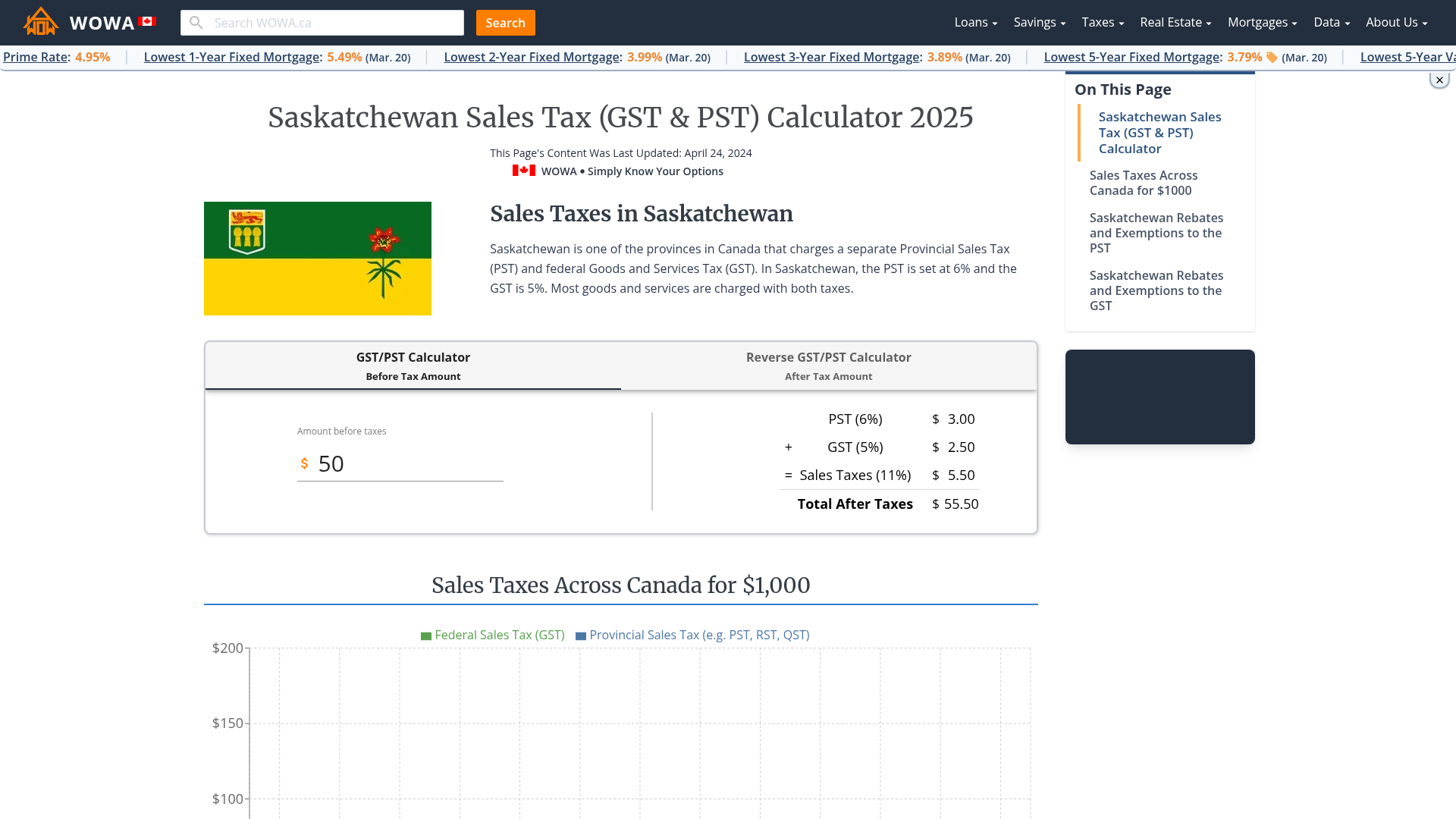

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

Land Transfer Tax In Toronto Ratehub Ca

Land Transfer Tax In Toronto Ratehub Ca

Alberta Gst Calculator Gstcalculator Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Protecţie Proaspăt Costum Canada Personal Tax Calculator Schwarzwald Hotel Org

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 5 1 Free To Download And Print Sales Tax Calculator Tax